Abstract

The purpose of this study is to examine interventions and supporting systems by dementia stage, take a look at dementia insurance policies in Korea and the United States, and present Korean private insurance programs for dementia patients. According to the study, our suggestions of a design of private insurance products for Korean dementia patients are as follows. First, the products should support people aged 80 and older. Second, new products should include the mild stage dementia in the insurance coverage. Third, non-pharmacological treatments, such as the cognitive stimulation, the cognitive training, and exercises need to be covered through the new private insurance. Fourth, the private insurance should be contained home health care services in its coverage. These suggestions can reduce the dependence of the public insurance, help people choose appropriate treatments for themselves, and give people a good opportunity to improve the effect of dementia treatment and to increase the satisfaction of patients and their families.

The life expectancy has been continuously extended due to the development of medical service technologies. Since the population of older people soars, the case and incidence of dementia increases consequently. The prevalence rate of dementia disease among people aged 65 and older accounted for 9.99% in 2015.1 The number of dementia patients came to 6800001 and that of mild cognitive impairment (MCI) patients is also increasing rapidly.2 During progressing the disease, dementia patients with difficulties in their daily living definitely need a help from someone. In the past, families of patients mostly took the responsibility for them socially and economically. However, recently, the nuclear family was increased and the thought of supporting for the elderly was diminishing. Therefore, the responsibility for taking care of dementia patients are moving from families to the national government. In this situation, the state expenditure of National Health Insurance (NHI) and long-term care insurance increase every year. This would probably result in considering more efficient execution of insurance spending for receivers. Therefore, benefits of the public insurance come to the dementia patients in a more serious condition and people suffering from early stage dementia get less support from the public insurance.

The number of dementia patients with 1, 2, and 3 grade of long-term care insurance who used care service were about 130000, which was equivalent to only 22% of 610000 total dementia patients in 2012.2 The rest of them, 480000, were cared by their families at home or be unavoidably in the long-term care hospital for a long time, or left untreated.

In this way, MCI patients cannot get any support from the long-term care insurance program and were left untreated. If patients get proper treatments, the progress of disease can be slow down. Appropriate dementia treatments may increase the duration of living a daily life. However, currently, only a few limited treatments for MCI patients can be covered by public or private insurance. Therefore, this situation leads the patient's families to spend a lot of money and time to care for them, and consequently causes financial difficulties of the patient's families, psychological problems such as depression of them, and physical health problems because they should care the dementia patient without any break time at home. This also results in increasing NHI spending on dementia patients' families as well as dementia patients.

Therefore, this paper examines interventions and supporting systems by dementia stage, takes a look at dementia insurance policies in Korea and the United States, and present Korean private insurance programs for dementia patients.

It requires an integrated approach such as pharmacological treatment, recognition interventions, non-pharmacological treatment, supporting a daily life, social support from patients' families, doctors, and experts in many different types of occupation when it comes to care for dementia.3 As this disease is chronically developed under different situations, each of patients has to be approached by patient-centric, coordinated care. Therefore, it is hard to simply divide a treatment plan by stage.

The first step of the treatment plan is an accurate diagnosis.3 According to this, doctors consistently treat the disease based on the problematic symptoms. To set up the treatment plan might change depending on the condition of the disease. Dementia patients at the mild stage have cognitive disorder including power of their memories and perform their usual activities in a daily life. For them, it requires the medication and cognition interventions to maintain the current status of the patients to the greatest extent.3 For MCI and the mild stage of dementia patients, it is necessary to carry on medication treatment as well as non-medication treatment such as cognitive stimulation, cognitive training, and exercises in order to increase the cognitive reserve of patients' brains, delay the progress of the disease, and relieve their symptoms.4 Even more than that, the music therapy, exercises, reminiscence treatment, reality orientation treatment are required for the treatment of behavioral and psychological symptoms of dementia as a non-medication treatment approach.5

The important thing during the treatment is to monitor its effects periodically.3 To assess the treatment periodically is helpful to check the effectiveness of the treatment, find out problems in advance, and decide to maintain the treatment or change it in time.

According to the status of Korea dementia patients in 2015, 680000 out of 6660000 elderly people suffered from the disease. Among 680000 dementia patients, 28.7% were men and 71.3% of women.1 This result might be related to the difference in average life expectancy between men and women. Based on age, the rate of dementia patients sharply increases when they are over 75 and the percentage of dementia patients over 75 contains 85.6%. Among them, around 40% of the patients are over 85 years old (Table 1).1

Clinical Dementia Rating (CDR) is one of measures to classify stages of the disease, which is used as a standard of provision of insurance premium by an insurance company.6 The following Table 2 is the incidence of the disease based on CDR announced by National Institute of Dementia in 2015. The proportion of the patients with the severe stage more than CDR3 is 15.8% of the whole patients and the rest was diagnosed from a very mild to a moderate stage (Table 2).1

In 2015 National Institute of Dementia Annual Report, Average annual spending for a dementia patient was 21590000 KRW (Korean won).1 Korean Association for Geriatric Psychiatry homepage presents the Alzheimer's disease progression classified into three stages: early, middle, and late stage.7 The early stage of the dementia is related to three years from a year to three years after diagnosing a dementia, the middle stage of it is seven years from two years to ten years after it, and the late stage of dementia is twelve years from eight years to twelve years after it.7 The personal necessary expenses for the long-term care for patients with the early stage for three years ranges from 47 million KRW to 52 million KRW, which runs to 1.4 million KRW a month.6 On the other hand, the expenses for middle and late stage patients for nine years are 65 million KRW, which runs to 600000 KRW a month.6 Since late stage patients can be supported by the long-term care insurance, their expenses are less than those for early and middle stage patients. If there are additional costs for non-pharmacological treatments such as cognitive stimulation, cog-nitive training, and exercises, the private payment by the early stage patients might be increased.

There are three types of insurance for dementia patients in South Korea. One is NHI that is the public insurance, another is long-term care insurance for the elderly which is the part of NHI, and the other is the private insurance.

First of all, NHI supports dementia patients who visit a hospital and fill a medicine prescription like the other diseases. The long-term care insurance supports the severe stage patients when they use care services, such as nursing home, daycare center, home care, and home nursing service.8 Since the special dementia grade- fifth grade-for patients of mild cases was introduced in the insurance in July, 2014, dementia patients who get the fifth grade can use cognitive activity programs to prevent the deterioration of their cognitive abilities and maintain remaining capacities three times a week or twelve times a month.9 However, fifth grade long-term care insurance beneficiaries can use only the cognitive activity program services without physical activity support, nursing home, and daily living support service. Therefore, the effectiveness and satisfaction of the insurance program for fifth grade recipients are decreasing.

The private insurance is sold by life insurance and fire insurance companies. There are 77 insurance products provided by 16 life insurance companies and 26 products by 8 fire insurance companies for supporting dementia as of July, 2016.10 98 products (95.1%) out of the total number of the products, 103, support the severe stage dementia patients, and 4 out of them (3.9%) support moderate and severe stage cases together.10 Then, only one product (1.0%) support only the mild stage case.10 The products only for the severe stage dementia patients led to attain only one percent of the payment of insurance money for dementia as of June, 2014.11 Also, since the insurance companies compensate the patients at a flat rate when they get the definite diagnosis of dementia and terminate it, it is hard for the patients to claim the insurance money by themselves. For this, there is a rule to designate the representative claimant for the money claim from insurance policy holders.

The below Table 3 is to compare the long-term care insurance as the public insurance and the private insurance for dementia patients.

Long term service and supports (LTSS) in the United States that includes dementia patients as beneficiaries started in 1965.12 Unlike the long-term care insurance based on the public insurance in Korea, LTSS is based on beneficiaries' assets. Thus, the U.S. government covers the insurance expenses for the public insurance beneficiaries. Then, people who don't come up to a standard of the public insurance should pay by themselves.

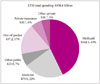

Fig. 1 shows LTSS spending by payer for 2013 in U.S.13 Public sources including Medicaid (42.7%) and Medicare (21.8%) account for the majority of LTSS spending (71.5%). Private sources including out-of-pocket (16.9%) and private insurance (6.1%) explains 28.5% of LTSS expenditures.13 Private insurance (6.1%) includes both health and long-term care insurance.13 Therefore, public sources account for the majority of LTSS spending (71.5%) and 28.5% of LTSS expenditures were paid by private sources.13

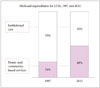

Since public sources such as Medicare, Medicaid, and others don't cover all LTSS, American citizens usually consider purchasing the private long-term care insurance for the future preparation. As for the private insurance, the deductible amount is very different depending on insurance plans, ages of insurance policy holders, and their physical conditions. Also, the ages have the greatest influence on the estimation of the deductible in the private long-term care insurance. Therefore, lots of U.S. people want to start their insurance plan as younger as possible. In addition, the U.S. executed affordable care acts in 2010, established community living assistance services and supports programs, and provided non-medical long-term services.12 Through this, the American central government transferred LTSS's nursing home expenditures to long term service expenses to lead to the effectiveness of the use of the expenses, and registered that 24% of Medicaid's home- and community-based service spending in 2011 jumped to 48% compared to 1997 like Fig. 2.14

Since the United States have different systems for the public and private insurance from those in Korea, there are many different types of insurance benefits for dementia patients in U.S.15 The patients can have various services, such as nursing home, home care, day care center, respite care, and others, including the treatment in a hospital through the public and private insurance coverage. If necessary, various experts visit to their home and give cares such as nurses, for medical needs, Physical therapists, to help restore mobility, Occupational therapists, to improve the ability to perform everyday activities, and Speech language pathologists, to help with speech, language, voice, cognition, and swallowing issues during the home care.16 Also, the patients can charge these costs to various payer. The patient's hospital or home care agency can help them determine what the patient's personal payment mix might look like based on their situation and any insurance or benefits they have.17 The following Table 4 is the example of Insurance and Benefit which patients can receive supports with their request for home care.

We examined the current status of dementia insurance in Korea and the United States and made suggestions for a new design of the private insurance for the dementia patients as follows.

First, since the dementia prevalence rate is increasing sharply when people become over 80 years old,1 the term of insurance should be changed to cover over 80 year old customers. Only few years ago, most of the insurance products supported the customer's health until they are 80 because Korea life expectancy was 80 years at that time. Therefore, it is necessary to design insurance products which are extend the term of the existing insurance considering the extended desired life time or which are covered over 80 year old customers. For example, if the actual property insurance that a woman aged 40 took it up five years ago is guaranteed until she is 80, it is required to extend the insurance term to guarantee until she is 100 by developing new products for people aged 80 and older.

Second, 84.2% of dementia patients are in the mild and moderate stage, and patients at the mild stage need to receive various treatments to slow down the progress of dementia including medication treatment and non-medication treatment. Thus, it is necessary to design insurance products for mild cases. If insurance products are designed for patients with serious dementia to receive one time fixed amount payment like the current private insurance products, the patients are less likely to spend the money for themselves. Also, the severe stage dementia patients can be recipients of the long-term care insurance, and in that stage, it might be helpful for themselves and their families to stay nursing home. Therefore, it is required to develop insurance products for the mild stage dementia patients and support them to slow down the progress of their disease to the greatest extent.

Third, the treatment for dementia includes medication treatments as well as non-medication treatments such as the cognitive stimulation, the cognitive training, and exercises with an integrated approach. Therefore, the private insurance should be designed to compensate actual service costs instead of fixed amount payment. The current actual property insurance supports patients only for hospital bills and medicine costs, except for non-medication treatments. Therefore, the dementia insurance should be designed to support the various treatments including non-medication treatments as prescribed by a physician.

Fourth, the home care service support is required for dementia patients as well as their families. The dementia patients' families are likely to have a mental and physical difficulty during patients' care. In this way, professional care givers can provide the home care service for patients in order to improve their health and even their families' psychological and physical conditions. Thus, if the private insurance products support home care services like the long-term care insurance, this might lead to slow down the progress of the disease and reduce NHI total spending.

It is expected that there will be a 3.3 times increase in the world population of dementia patients in 2050 compared to 2013, and in Korea, the number of the dementia patients will account for 2710000 in 2050 with an 4.7 times increase compared to 2013.18 As the number of the patients rapidly increases now, amounts paid for the NHI and long-term care insurance continue to increase too. Also, there is a limit to demand a high quality of service for dementia patients from the public insurance. Due to high hospital bills for the mild stage treatments, the development of private insurance products which can meet the needs of the patients is so much needed.

Suggestions of a design of private insurance products for Korean dementia patients are as follows. First, the products should support people aged 80 and older. Second, new products should include the mild stage dementia in the insurance coverage. Third, non-medication treatments, such as the cognitive stimulation, the cognitive training, and exercises need to be covered through the new private insurance. Fourth, the private insurance should be contained home health care services in its coverage.

These suggestions can be the first step to prepare for the future by ourselves when we are healthy not depending on only the public insurance. Furthermore, these new private insurances can make people reduce the dependence of the public insurance, help people choose appropriate treatments for themselves, and give people a good opportunity to improve the effect of dementia treatment and to increase the satisfaction of patients and their families.

Figures and Tables

Fig. 1

2013 LTSS spending by payer in U.S. Adapted from Congressional Research Service.13 LTSS: long-term service and supports.

Fig. 2

Medicaid expenditures of LTSS, FY 1997 and FY 2011. Adapted from National Health Policy Forum.14 LTSS: long-term service and supports.

Table 3

Comparison between public long-term care insurance and private insurance

Adapted from Korea Consumer Agency.10

Acknowledgements

We wish to express gratitude to Kwijoo Kim and Heejeong Jeong in BAYADA Korea Home Health Care for their data collection support in this article.

References

1. National Institute of Dementia. 2015 National Institute of Dementia Annual Report. cited 2016 Nov 2. Available from: http://www.nid.or.kr/info/dataroom_view.aspx?BID=137#.

2. Ministry of Health and Welfare. 2013 dementia prevalence rate research. cited 2016 Nov 2. Available from: http://www.mohw.go.kr/front_new/al/sal0301vw.jsp?PAR_MENU_ID=04&MENU_ID=0403&CONT_SEQ=286138.

3. National Institute of Dementia. Dementia treatment. cited 2016 Nov 7. Available from: http://www.nid.or.kr/info/diction_list7.aspx?gubun=0701.

4. National Institute of Dementia. Dementia non-medication treatment. cited 2016 Nov 7. Available from: http://www.nid.or.kr/info/diction_list7.aspx?gubun=0704.

5. Park KW. Non-pharmacological approach to BPSD. Dement Neurocognitive Disord. 2004; 3:24–28.

6. Korea Insurance Research Institute. Introduction of insurance company's dementia trust for the protection of mild dementia. cited 2016 Nov 7. Available from: http://www.kiri.or.kr/pdf/전문자료/KIRI_20150317_18399.pdf.

7. Korean Association for Geriatric Psychiatry. Geriatric psychiatry information. cited 2016 Nov 7. Available from: http://www.kagp.or.kr/caller/intro.html.

8. National Health Insurance. What is long-term care insurance? cited 2016 Nov 7. Available from: http://www.longtermcare.or.kr/npbs/e/b/101/npeb101m01.web?menuId=npe0000000030.

9. National Health Insurance. FAQ: service for fifth grade. cited 2016 Nov 7. Available from: http://www.longtermcare.or.kr/npbs/d/m/000/moveBoardView?menuId=npe0000000440&bKey=B0055&search_boardId=962.

10. Korea Consumer Agency. Problems and improvement of dementia insurance for elderly consumers. Available from: http://www.kca.go.kr/brd/m_46/view.do?seq=1985&itm_seq_1=4.

11. The Affairs Committee. Insurance business act revision (request number: 15621). cited 2016 Nov 11. Available from: file:///C:/Users/Administrator/Downloads/151014c_보험업법_일부개정법률안(정부_15621호)_의%20(1).pdf.

12. The George Washington University. The Basics national spending for long-term services and supports (LTSS). 2012. cited 2016 Nov 11. Available from: https://www.nhpf.org/library/the-basics/Basics_LTSS_03-27-14.pdf.

13. Congressional Research Service. Who pays for long-term services and supports? A fact sheet. cited 2016 Nov 11. Available from: https://fas.org/sgp/crs/misc/R43483.pdf.

14. National Health Policy Forum. National spending for long-term services and supports (LTSS). 2012. cited 2016 Nov 11. Available from: http://www.nhpf.org/library/the-basics/Basics_LTSS_03-27-14.pdf.

15. Korea Insurance Research Institute. Status of insurance market for elderly people and overseas cases. cited 2016 Nov 11. Available from: http://www.kiri.or.kr/pdf/%C0%FC%B9%AE%C0%DA%B7%E1/KIRI_20150216_14557.pdf.

16. Bayada Home Health Care. Home health care. cited 2016 Nov 14. Available from: https://www.bayada.com/homehealthcare/services/home-health-care.asp.

17. Bayada Home Health Care. How to pay. cited 2016 Nov 14. Available from: https://www.bayada.com/homehealthcare/how-to-pay/index.asp.

18. Seo YJ. World dementia patients' number will be 100 million in 2050. The Joongang Ilbo;2015. 01. 27. cited 2016 Nov 14. Available from: http://news.joins.com/article/17027521.

PDF

PDF ePub

ePub Citation

Citation Print

Print

XML Download

XML Download