OVERVIEW

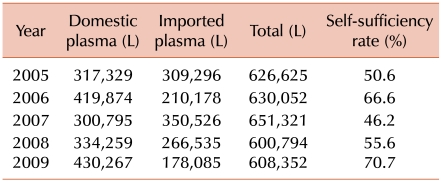

The plasma supply for pharmaceutical manufacturing consists of surplus plasma recovered from whole blood collection and source plasma from plasmapheresis in Korea. Shortages are typically covered by importation. The total plasma supply for fractionation was 608,352 liters in 2009, of which 430,267 liters were supplied domestically. The self-sufficiency rate was, therefore, about 71% in terms of domestic demand.

The fundamental policy for supplying plasma derivatives was established by the government in 1978 following the recommendations of WHO and IFRC (International Federation of Red Cross), based on 'blood self-sufficiency' and 'exclusion of commercialism'. Since then, the government has been maintaining a public arrangement for plasma fractionation and authorized the delegation of supplying plasma and plasma products to the Korean Red Cross (KRC) through the revision of Pharmaceutical Affairs Law in 1986.

According to this policy, permission for fractionation and importation, inspection of potentially importing blood collection centers, and regular audits of plasma importers, have been all granted and executed by KRC. Moreover, KRC pushed ahead with its plan to produce end-products, and built a plasma fractionation center in 1991. However, the original plan was abandoned due to over-investment disputes, and currently, KRC processes plasma to manufacture only a few intermediate products such as 20% albumin solution, immunoglobulin fraction, and cryoprecipitate. These intermediaries are purchased and further manufactured to end-products by the pharmaceutical companies-Green Cross and SK Chemical.

Thanks to the public management policy, the price of domestic plasma products has been maintained at a moderate level compared to other countries, and the domestic fractionators have been able to improve their competitiveness. On the other hand, the current manufacturing chain has somewhat unreasonable aspects. This systematic absurdness has been a real obstacle to achieve plasma self-sufficiency until today.

FRACTIONATION PROCESS OF PLASMA DERIVATIVES

To make final products from recovered or apheresis plasma, frozen plasma must be thawed and processed through several steps. Through centrifugation and ethanol precipitation, coagulation factor IX, coagulation factor VIII (FVIII), fraction II (used as fibrin sealant), immunoglobulin (IG), fraction IV (anti-thrombin), and fraction V (processed to albumin) are fractionated respectively. One liter of plasma produces 0.63 bottles (250 units/bottle) of FVIII, 1.5 bottles (50 mL/bottle) of IG, and 1.4 bottles (100 mL/bottle) of 20% albumin.

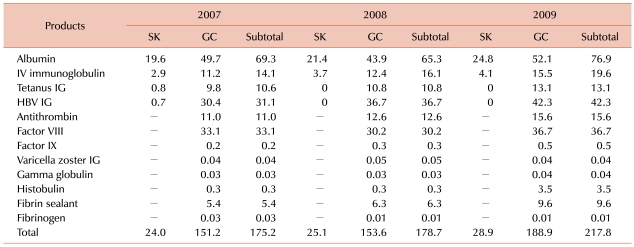

Green Cross produces 12 kinds of end-products, while SK Chemical makes only two. The market share of Green Cross is about 87% of total sales in 2009. Among pharmaceutical products, tetanus IG, hepatitis-B IG, and Varicella zoster IG require special plasma, which should be imported as the Blood Control Act in Korea prohibits paid donations of such blood. Total sales were about 178 billion KRW in 2009 (Table 1).

RECENT CHANGES IN THE GLOBAL AND DOMESTIC MARKET

Demand for plasma for fractionation is about 25 million liters annually worldwide, of which the United States supplies about 64%, primarily due to the commercialized blood system. Most other countries have a voluntary, non-remunerated plasma donation policy.

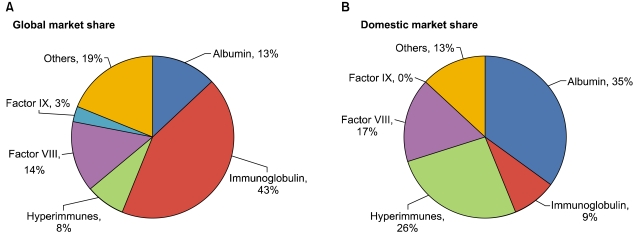

Among all the plasma products, global market share for IG is approximately 43%, while that of albumin is a mere 13%. As medical indications for IG steadily expand, the demand for IG is expected to increase 5-8% annually until 2012. Conversely, controversies about the efficacy of albumin are likely to cause gradual decrease in demand. There is a striking contrast in Korea. The market share for albumin is 35-40% and that of IG less than 9% (Fig. 1). The remarkable consumption of albumin is due to a traditional tendency toward prescription, and without groundbreaking regulations, such over-consumption practice seems to continue for some time. The demand for IG, on the other hand, is likely to increase steadily. The demand for coagulation factors is expected to diminish, as the recombinant products are gradually replacing the plasma derived products.

The global plasma products' price has greatly fluctuated due to demand-supply imbalance during recent decades. Although the current situation is much stabilized than before, the price of imported plasma can fluctuate at any time depending upon the global market situation and this is another reason why self-sufficiency is to be achieved.

SUPPLY PROSPECTS IN KOREA

Our definition for plasma self-sufficiency should be set primarily based on albumin demand - the largest portion of all plasma products. Therefore, with considering the fact of an increasing trend of IG demand, the total domestic plasma demand for fractionation hovers at about 650,000 liters. Subtracting 50,000 to 100,000 liters for special plasma, which should be imported, a real target for plasma self-sufficiency will be 550,000 to 600,000 liters.

After introducing plasmapheresis in 1991, KRC's plasma collection number reached 465,350 in 2009. The widespread awareness of donors on the importance of plasma donation as well as the construction of blood donation centers has played a significant role in this remarkable growth. However, the blood shortages for transfusion have always affected the plasma supply as KRC should prioritize the needs of fresh blood products. Reviewing the plasma supply over the past 5 years, the plasma self-sufficiency rate dropped to a low of 46% in 2007, correlating with a serious domestic shortage of whole blood (Table 2). The reconstruction-associated prolonged shutdown period of KRC's new plant in that year was another contributing factor. As the donation number increased, the plasma self-sufficiency rate restored up to 71% in 2009. Considering about 2.57 million donations in 2009 and given our target as 600,000 liters a year, the additional collection of 340,000 liters of plasma will meet the achievement of plasma self-sufficiency. With the continuous improvement in the donor recruitment and retention, this seems to be a reasonably achievable goal.

PROBLEMS AND SUGGESTIONS

There are several unreasonable contradictions as potential threats in current plasma supply chain. Most important factor is that the plasma and intermediaries' price is determined by the negotiation between KRC and pharmaceutical companies. So the increase of collection and processing cost can hardly be compensated appropriately. This can lead to financial problems of KRC in terms of operating blood centers and plasma fractionation center. The cost for apheresis plasma has been continuously increased due to several factors such as implementation of nucleic acid amplification test or inventory hold to improve the blood safety. The periodic review of the plasma pricing and setting by the government in accordance with the end-product price-setting seems to be imperative to solve this situation.

Current dual pricing system for recovered and apheresis plasma due to the difference of collection cost forces KRC plasma fractionation center's operation rate below optimal level. So the adoption of dual pricing system for intermediaries according to the raw material cost difference to enhance the KRC fractionation center's efficiency should be considered.

Lastly, we should think about the original idea of KRC's role in the public management policy of plasma products. In Japan, the donors easily accept the concept of plasma self-sufficiency and donate plasma because Japanese Red Cross, a well-known non-profit organization, manufactures several kinds of end-products. Meanwhile in Korea, some people have a doubt that the donated plasma is just used to make pharmaceutical manufacturers' profits. So, the ideal role and responsibility of KRC and pharmaceutical industry should be discussed and settled to maximize the public interest and to achieve the goal of plasma self-sufficiency.

PDF

PDF ePub

ePub Citation

Citation Print

Print

XML Download

XML Download